Wall of Fame

100% REPAID

Lilashah Mahila Mandal Group

Gandhidham, India

Mayaben, the lady in the center hails from Kutch, Gujarat. She runs her own small business supplying tiffins within her neighborhood. She buys fresh ingredients from the market, cooks delicious healthy meals, and delivers them as packed lunches to her customers. Through this, she earns a monthly income of Rs. 5,000, which, put together with her husband’s income of Rs. 7,000, is used to cover living expenses for her family. Her household of five includes her teenaged child; they live in the Kutch district of Gujarat, in western India.

Maya, who did not go to school due to poverty, wants to ensure that she can give her child access to a life better than hers through education. But with household savings of Rs. 2,000 this seems to be an impossible task.

Maya has come together with a group of women to crowdsource a loan of Rs. 75,000. With her share of the loan, Maya will expand and grow her tiffin business, allowing her to reach out to more customers and increase her household income by 60 percent. She will be able to buy more ingredients and produce, and take on more orders. As business grows, she may even hire a helper to cater to more orders. With the projected increase in business, she stands to net an additional Rs. 8,000 a month. She will invest about 35-40 percent of this back into growing her business further, so that its growth becomes self-sustaining. The rest, she will take home as personal savings.

Like Maya, group members Pusphaben, Soniyaben, Sushila, and Kalavati are all married with children and looking to start or grow their own respective petty shop, cloth selling, and papad making microenterprises.

All these women seek the loan to make their households more financially stable and provide an education for their children, something they never had access to. Your loan will empower five hardworking, industrious women to secure their children’s future. Mayaben, in particular, expresses her gratitude for your support and this opportunity.

Nhóm 05 Thôn Thạch Bắc Xã Quảng Thạch Group

Thanh Hoa, Vietnam

Mrs. Nên operates a food stall selling fish. She is requesting a loan to purchase more tools to catch fish for sale.

Nên is 36 years old and married with four children. She is the group leader of the Nhóm 05 Thôn Thạch Bắc Xã Quảng Thạch Solidarity Group, which consists of six members. She lives and works in Quang Xuong district, a rural area in Thanh Hoa province.

In 2013, Nên joined Thanh Hoa Fund for Poor Women to improve her business. Nên has successfully repaid three loans from Thanh Hoa Fund for Poor Women.

Nên has been involved in this business for eight years. The main hardship that Nên faces in her business is the lack of capital.

In the future, Nên hopes to maintain a successful business, for her children to do well in school, and for her family to be healthy and happy.

Christine

Owijiono, Uganda

Christine is 39 years old and lives in the town of Owijiono in the Mbale region of Uganda. She is divorced, and has four children, with two of them currently in school. For the past five years, Christine has been working hard to manage her boutique, which sells clothes.

To help expand her business, Christine has requested a loan of 2,500,000 Ugandan Shillings from BRAC Uganda. The loan will be used to purchase adult and baby clothes to sell, and will help Christine to generate greater profits and see her children in better schools. Christine hopes that in the future she will be able to improve on the business.

Christine is a member of BRAC's Small Enterprise Program (SEP). The program primarily serves small entrepreneurs like Christine who do not have enough collateral for commercial loans, but have businesses that have grown too large for microloans.

Sea

Tboung Khmum District, Cambodia

Sea K., 47, is a widow with two school-aged children. She resides in Kampong Cham Province, Cambodia, with her parents and children. To make a living, she runs a business of selling Cambodian traditional foods made from fish. This kind of food can be kept for a very long time over the year. She is able to earn an income of US $5.9 per day.

K. and her family members are seeking to improve their standard of living and generate a better income. Therefore, K. is asking for a loan of US $1000 to purchase more traditional food to expand her business. She hopes that she will be able to make more profit when she retails the food to her customers. This is her second loan from CREDIT, Kiva’s partner.

Comite Las Amigas Group

Caacupe, Paraguay

The Women Entrepreneurs Committee “Las Amigas” is made up of 18 women, all from the same neighborhood. They are currently in their 13th loan cycle as part of the Fundacion Paraguaya Women’s Entrepreneuship Program. With each loan cycle, they all participate in training workshops where they learn how to save, budget and market their businesses. They use their loans to expand their businesses, which involve selling clothing and furniture, and running manicure salons and food stands where they sell “chipas," a traditional Paraguayan cheese bread.

Allah Kan Dèmè Group

The Allah Kan Dèmè group comprises six women, living in the Hamdallaye area of the town of Ségou (in the 4th administrative region of the Republic of Mali). They are on average 34 years old with 3 children. They met each other through neighbours and through their businesses, and they sell a variety of products.

Having repaid their first joint loan without any problem, they are now on their second loan with a view to diversifying and making their business profitable. This loan will be used to buy 3 pieces of 30-meter long white bazin, 10 wax-printed loincloths, 35 items of children's clothing (baby clothes, dresses, trouser suits, skirt suits), 20 sets of chains, earrings, bracelets and some rings, 12 bottles of varnish, 12 khol pencils, 250kg of rice and 500kg of "fabourama" tubers.

They are expecting to make an average monthly profit of 27,835 FCFA which will be used to repay loans, and also to contribute to household expenses and social events (baptisms, marriages, circumcisions and funerals), the purchase of items which will gradually make up young girls' marriage trousseaux as well as the building up of savings.

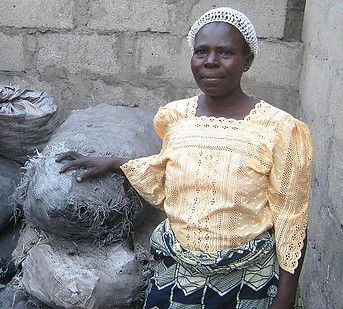

Suyibatu

Suyibatu is 50 years old, married, and has 5 children. All of her children are university students. She sells bags of charcoal in her house to earn a living, and she has been in this business for 9 years. She is very determined to pull her family out of poverty. She sells for long hours to enable her to support her husband and her children in school.

Suyibatu is a LAPO client. LAPO (Lift above Poverty Organization) is committed to improving lives in Nigeria and elsewhere in Africa. She hopes for a loan of NGN 100,000 to purchase more bags of charcoal to sell. She expresses her gratitude to all Kiva lenders.

Hernestina

Hernestina is a single mother who was born in the city of Cusco. She belongs to the Arariwa Association's "Patron Santiago de Santiago" communal bank. She has a daughter, Elizabeth, who is 18 years old and preparing to enter the university.

Hernestina divides her time between her work at home and her business selling fruits and vegetables. She has a stand in Cusco's “Cascaparo” market. She has operated this business for several years, and it has gone very well for her, thanks for all of the effort and dedication she puts into her work. She is a hardworking and entrepreneurial mother who is helping her family get ahead. She needs a loan to buy more fruits and vegetables, such as onions, cabbage, lettuce, and much more.

She is grateful for the opportunity provided to her in this manner, and she is committed to making her payments on schedule.

Cobol Group

Bolivia

The group "Cobol is represented by Carolina Kati and is made up of 10 members who are service providers. They are hairdressers, mechanics, contractors, drivers and builders. Some sell products such as food, clothes for women and shirts for men. The members working in this line of business operate sales stands at the entrance to the market hall, and so one might say that they are "well-positioned" to generate enough income to recover their capital and earn profits to support their families. This loan will be used for the acquisition of new merchandise for the holiday season and new year as well as the acquisition of tools of the trade that contribute to the generation of better profit for the service providers. As for the experience of the members, they know well how it works in loan groups in institutions similar to the Agrocapital foundation, for whom they are thankful for the confidence and the economic help so they can get ahead.

Erina Bright School

Jennifer is the Director of Erina Bright Primary School, a mixed school in the Urban area of Makindye in Kampala with 480 students. Erina Bright School has requested a loan to cover the cost of installing and maintaining a UV water filtration system to provide clean drinking water for its students. The school does not currently have access to consistent clean drinking water and therefore has to spend a considerable portion of its budget on firewood, which is used to boil water for the children. Installing a water filtration system will therefore save the school money in the long-term as the cost of firewood will be reduced. The loan will enable the school to purchase a UV water treatment system with a 750 litre tank, which will be big enough to store clean drinking water for the students every day.

Erina School will repay their loan from their school fees, which they collect each term. Jennifer ultimately hopes that having access to safe drinking water will improve her student’s concentration and attendance by reducing the number of children that fall sick from water-borne diseases as well as increase the number of students coming to the school.

Estela Benita

Nicaragua

Estela is 51 years old; this is by no means her first loan from the Foundation and she has been an excellent customer with her previous loans. She runs a small store which is her sole source of income. She was able to use her income from the store to provide for her 3 children who now are grown and work on their own.

The loan is for working capital to purchase sugar, soap, detergent, milk, juice, and drinks. In spite of having to get up very early to go to the market to purchase her goods and running from store to store to get the cheapest items, she is always smiling as she works hard to improve her standard of living.

Rose

Rose is a very successful and hard-working woman of 46 who is married with five children. She lives in Lagos where she has had a business selling groceries and drinks for over eight years. She manages the business with the help of her husband.

Rose is requesting NGN 140,000 to purchase more groceries and drinks to sell as this will enable her to expand her business and increase her profit. She says thanks to all Kiva lenders.

Mrs. Sopha Sang Village Bank Group

Cambodia

This village bank loan is made up of fourteen people, all of whom are villagers in Kampong Svay Leu village in Kandal province. Mrs. Sopha S. is the village bank president who has been selected by all the group members. Each member will use their loan for a different purpose.

Mrs. Sopha S. is a farmer who owns a plot of land to grow brown sapote and vegetables, which she sells to support her family. Her husband, Mr. Yoeurn Y., is a construction worker. In growing brown sapote, Mrs. Sopha S. has a problem because the field has a lot of insects and she does not have enough money to address this problem. Therefore, she has decided to ask for loan to buy pesticide to protect her field. With the rest of the loan she would like to build a toilet for personal use. Mrs. Sopha S. is a mother of five children – one is a seamstress in a garment factory while the others attend the local public school.

Patience

Patience is 40 years old and is married with five children: a boy and four girls. Her husband is a carpenter and he also supports their home.

Patience fries and sells potato chips and is well known in her neighborhood for her chips. She hopes to grow her business so that it becomes bigger and stronger in the future.

Patience is requesting a loan of NGN 50,000 to purchase more cooking oil and potatoes to fry more potato chips to sell. She says thanks to all Kiva lenders.

Vallecito Group

Peru

Our members belong to the “Vallecito” communal bank. They live in the Huanchac district, in the Cusco province, in the department of Cuzco.

Our member is Lidia. She is 37 years old. She lives with her partner in the San Sebastián district. She alternates her domestic activities with retail. She helps her partner with carpentry. She puts the finishing touches on the different items of furniture and together they are a team. Lidia needs the loan to buy a planer, a circular saw, and a wire brush.

Our members alternate their various activities with retail, mostly in services such as renting cell phones for individual calls, carpentry, costume jewelry, taxi rides, bread store, grocery store, book store, and school transportation. Our members are requesting the loan to reinvest in their different businesses.

Chhern's Group

Chhern’s group live in a rural village in Kandal province in Cambodia. Chhern makes a living cultivating rice and she also does extra work as factory laborer to support her family. In their village there is no reliable access to safe, clean drinking water. Having a water filter at home will help each of these women to safeguard the health of their families and save money on medical expenses and save time collecting fuel and boiling water.

Sri

Indonesia

Sri lives in Turen, Malang Regency on Java Island in Indonesia, one of the most populous places in the world.

In Indonesia, you cannot drink city water and most people don't even have access to piped water. Therefore, most Indonesians depend on purchasing or boiling water. Sri attended a meeting by Nazava's sales team about alternative houshold water treatment options. There she learnt about Nazava Water Filters. Nazava Water Filters filter well, rain, and city water so it becomes safe to drink without boiling, without using fuel or electricity

Sri who is also a health worker took the opportunity and became the reseller of Nazava water filters in her community. This is the first time Sri has applied for a loan. She has an excellent record in repaying her loans.

This loan will allow Sri to buy 10 filters and sell them on consignment to her community making safe drinking water available to 50 people.

Anyway P.

Anyway is 22 years old and lives in the Nyanga District of Zimbabwe. She has been successfully operating a small grocery shop for over two years, selling groceries, toiletries, and cell phone minutes. Anyway used her first Kiva loan to expand her business and now sells clothing as well. She was also able to purchase a refrigerator for her shop for perishable goods. She pays her younger sister’s school fees and contributes to her family’s needs.

Anyway seeks a second Kiva loan to further expand her business and increase her selection of goods. The interest on her “social-interest” loan will continue to be repaid through her weekly volunteer work as a Camfed Learner Guide. Anyway offers training in life and leadership skills to students in her community.

Hamufari

Zimbabwe

Hamufari is a single mother of two boys, and lives in the Nyami-nyami District of Zimbabwe. Hamufari and her young sisters operate a grocery shop, in which they sell groceries, soap, and other home essentials. Hamufari used her first Kiva loan to increase stock. Hamufari is able to be self-reliant through the success of her business. She has been able to afford not only her sons’ school fees, but also the tutoring and examination fees she needed to complete her own secondary education.

Hamufari seeks a second Kiva loan so that she may further expand her grocery business. Hamufari serves as a Camfed Seed Money Scheme Trainer, empowering young women in the community to be economically independent. She also coordinates the movement for HIV/AIDS awareness in her community, and will continue to repay the interest of her “social-interest” loan through her weekly volunteer work as a Camfed Health Activist.

Pablita

Pablita is an entrepreneur from Novaliches, Philippines, and a member of Center for Community Transformation (CCT). As a source of income, her husband, Elino, works as a construction worker while she’s managing their internet café business. Typically, most internet cafés in the Philippines charge 15.00 to 20.00 Philippine pesos (PHP) per hour. There are some internet cafés that have a machine attached to each computer somehow like a vending machine. The customer drops in a 1.00 peso coin, which is equivalent to 5 minutes' usage of a computer and the internet. That’s how Pablita’s internet café works. It is also known as “piso net” in the Philippines (piso means Philippine peso).

The internet café is earning approximately 10,000 PHP each month. Pablita is aiming to add computer units to increase the business’ revenue and to have all of her computers upgraded as well. That’s why Pablita decided to apply for a 35,000 PHP loan. She’s aiming to have a bigger internet café someday that can accommodate more customers.

Tehila Group

Zimbabwe

Nomusa started business back in 2012 selling plates and cups before she became a full time cross border trader in May 2015. She is now selling comforters, sheets, blankets, clothes and solar lights. Nomusa formed a group with 4 ladies who are as hard working as she is. The group is called Tehila.

Nomusa is a 30 year old lady and a mother of 3 children. Her husband supplies fruit and vegetables. Nomusa helps the family through buying food in the house and even helping to pay for the childrens’ school fees.

Nomusa wants to buy solar lights, clothes, shoes, and comforters because she has many orders which she needs to supply. Nomusa benefited from the training because she was only keeping debtors records she is now able to keep daily record sheet for her business. Nomusa hopes to implement all the lessons in her business and she want to use the loan more effectively.